Learn More

Learn More

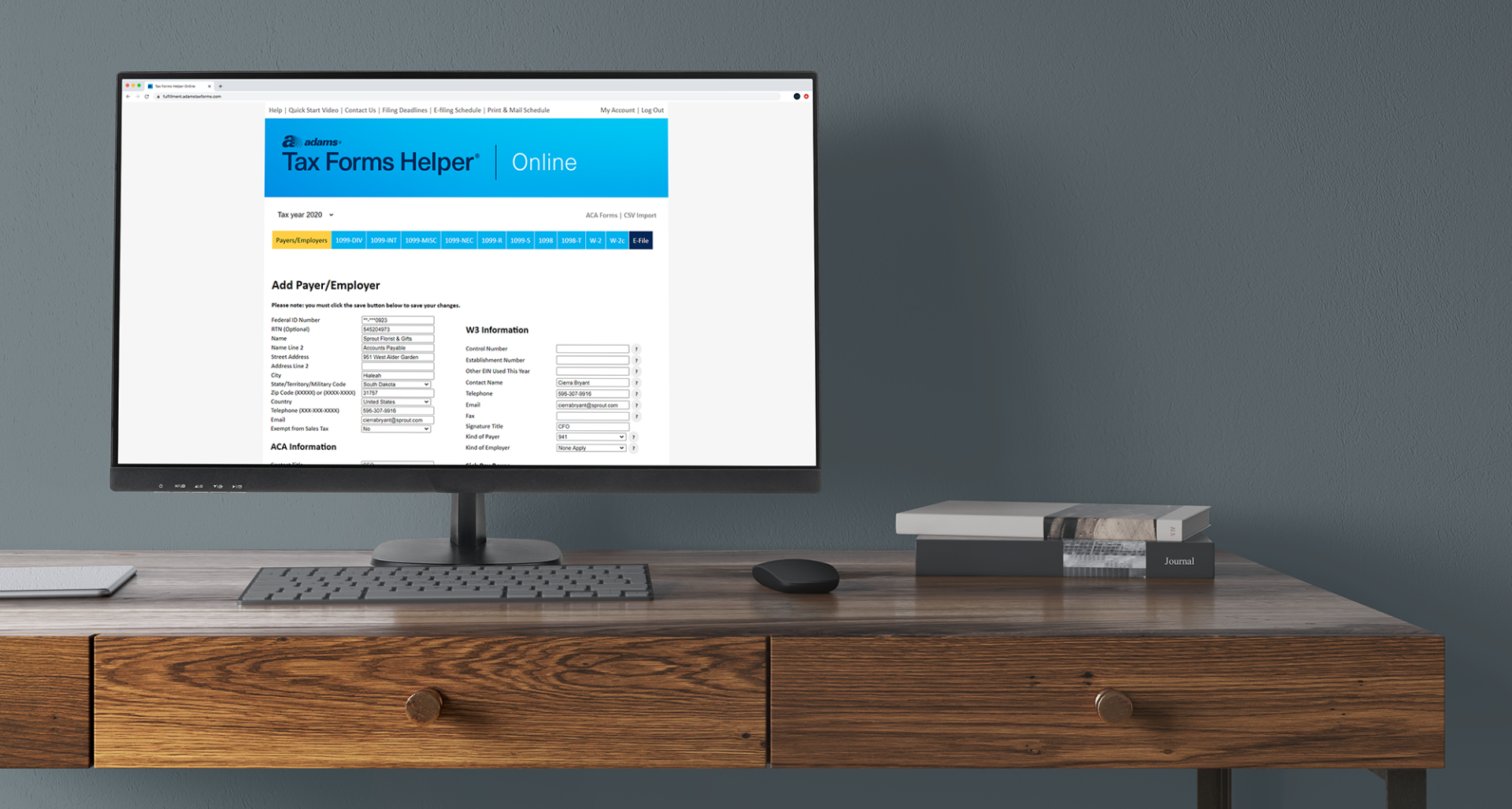

Explore Adams® Tax Forms Helper® Online

Meet your helper.

Adams Tax Forms Helper Online is a web-based tax filing service that helps small businesses prepare tax forms for contractors and employees.

All you need is your favorite search engine and internet access from your Mac or PC.

For businesses, big and small.

We help companies of all sizes, from CPA firms to small businesses and individuals.

Whether you’re running a household with a nanny or an enterprise with 1,000 employees, we’ll help you prepare professional W-2s and 1099s in minutes.

Time-saving features for your 2020 taxes.

This speedy interface is where you’ll build fillable, printable 1099 forms and W2s. Prepare one, or hundreds at a time.

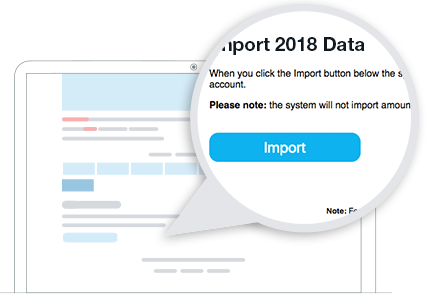

Importing is easy

Import last-year’s data from Tax Forms Helper Online in 2 clicks.

Your 1099-MISC will import into the correct 1099 form (NEC, MISC or both) for 2020.

Or import data from a CSV or Excel file, no matter what program you used last year.

Keep your print settings

Tax Forms Helper remembers the 1099 or W-2 forms you printed last so you can make reports or reprints in seconds.

Error-proof your transmittals

Roll-up function fills in your 1096 and W-3 transmittal reports instantly.

Control the way you view your data. Parse reports by one, multiple or all payers.

Enter tax IDs once

Tax Forms Helper autofills your payers’ state tax id number to reduce the risk of errors.

See accounts clearly

Account numbers and names and payer names 1 and 2 display on-screen and appear on all your printable reports.

Faster, safer, web-based business taxes.

We started out on CD, but we promise you won’t miss the disc. You'll save time and storage space with our online application.

Down with downloads & updates

Since we’re web-based, we’re always current. There’s nothing to install. Just pull us up on your web browser. When you’re ready to log in, we’re ready to work.

Safe and secure

Data saved to a USB or laptop is vulnerable to theft or loss. (And when was the last time you backed up your Mac or PC?)

With cloud-based storage, your data is saved with 256-bit AES encryption—military-grade classified data storage.

Ready, set, print.

With your data ready, you can print directly onto genuine Adams® tax forms. Our new PDF printing guidelines help you produce precisely aligned forms with ease.

E-filers simply print copies for employees and recipients as needed. You'll get professional-looking forms from your laser or inkjet printer.

Prepare Common Tax Forms.

You can e-file your W-2 and W-3 forms to the SSA, e-file your 1099-MISC, 1099-NEC, 1099-INT, 1099-DIV, 1096 and 1098 forms to the IRS, and e-file forms to select states.

Wage and Tax Statement Forms

W-2

Wage and Tax Statement Form

W-3

Summary Transmittal Form for the W-2

Miscellaneous Income Forms

1099-MISC

Miscellaneous Income Form

1099-NEC

Nonemployee Compensation Form

1096

Summary Transmittal Form for the 1099

Other Income

1099-INT

Interest Income Form

1099-R

Retirement Distributions Form (for Pensions, Annuities, Profit-sharing, IRAs, Insurance Contracts, etc.)1099-DIV

Dividends and Distributions Form1099-S

Proceeds from Real Estate TransactionsInterest Statements

1098

Mortgage Interest Statement1098-T

Tuition StatementCorrected Wage & Tax Statements

W-2C

Corrected Wage and Tax StatementW-3C

Corrected Transmittal of Wage and Tax StatementPop quiz: What type of filer are you?

Paper, e-file or full service? With Adams, you have options.

|

|

|